- Home

- Blog

- Property Search

- Search By City

- Search By Area

- Search By Map

- Search By Subdivision

- Search By School

- Search By MLS#

- Search By Address

- Daniel Island Homes

- Goose Creek Homes

- Isle of Palms Homes

- Historic Charleston Homes

- James Island Homes

- Johns Island Homes

- Mount Pleasant Homes

- North Charleston Homes

- Sullivans Island Homes

- Summerville Homes

- Foreclosures

- Historic Homes

- Buying

- Selling

- Charleston Area Info

- About

- Contact

- My Profile

Announcing – Closing Cost / Down Payment Assistance using the $8,000 First Time Home Buyer Tax Credit

Begin your Charleston Home Search here! Featuring: Historic Charleston Homes, Luxury Waterfront Condos, Golf Course Homes, Charleston Area New Homes for Sale, and NOW Charleston Foreclosures & Bank Owned Properties. Charleston, SC offers living for any lifestyle.

Posted By Heather Lord @ Jun 8th 2009 11:10pm In:

General

Announcing - Closing Cost / Down Payment Assistance using the $8,000 First Time Home Buyer Tax Credit

Announcing - Closing Cost / Down Payment Assistance using the $8,000 First Time Home Buyer Tax Credit

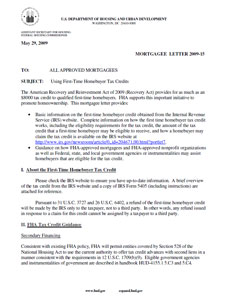

First-time homebuyers (and Realtors!) have been eagerly awaiting the official announcement from Housing and Urban Development (HUD) and the Federal Housing Administration (FHA) regarding the use of the $8K Tax Credit to assist with Down Payment and Closing Cost Fees.

Well, it has finally arrived, and it's exciting news for anyone thinking about purchasing that first home. (Click on the Graphic to read the Official Mortgagee Letter)

Basic Info on the Down Payment Assist Program

Previously, first time buyers could get the $8K credit, but only as a part of their tax return. A nice benefit, but you had to buy the home first in order to receive the tax credit. This recent change enables first-time buyers to use the benefits of the federal tax credit upfront!

Qualified first-time home buyers using an FHA mortgage can use the tax credit towards additional down payment, closings costs or to help buy down the interest rate.

That's a big difference that can help make home ownership more affordable!

Are there terms, restrictions and paperwork? You bet there are...

- In order to qualify, you have to use an FHA loan and an FHA loan requires you have your own 3.5 percent down payment.

- Interested home buyers need to purchase their homes by November 30th to qualify for the money.

- The tax credit is 10 percent of the price of the home up to $8,000.

What Do They Mean by "Up to" $8000?

That's an important question. The credit is equal to 10% of the purchase price, up to $8000. So, if you purchased a $60K home, the credit would be $6K. An $80K home, the credit would be $8K. A $100K home, the credit would still be $8K.

Can I Use the Money for my Down Payment and Closing Costs?

Yes, with the exception of the standard 3.5% down payment that FHA requires. The credit cannot be used to cover the minimum 3.5%.

Do I have to keep the Home for a Certain Period of Time?

Yes...at least three years, or you have to pay back the amount of the credit you claimed.

There are many other things you need to know regarding qualifications and procedures. Here are some official IRS links to get you started.

First Time Homebuyer Credit page.

Please contact Heather at hlord@HeatherLord.com to get started on your home search right away! Or to search for that perfect starter home with no registration required please visit https://www.heatherlord.com/property-search.html

Share on Social Media:

Contact Heather Lord today for all your Charleston, SC Real Estate needs!

Quick Search

Advanced Property Search Types

Recent Blogs

Charleston SC Real Estate 2017 is Hot !!

Posted Tue, Apr 4th 2017 11:00 am

1725 Brittlebush Ln ~ Johns Island SC ~ Whitney Lake ~ 3 Bdr Townhome with Gorgeous Lake View

Posted Tue, Jun 21st 2016 2:58 pm

Charleston SC - REALTORS need more Homes to Sell!

Posted Wed, Mar 11th 2015 2:00 pm

Charleston Real Estate Blog

- All Categories (46)

- Charleston Area Properties (6)

- Charleston Properties (6)

- Charleston SC Animal Info (1)

- Charleston SC Boeing Jobs (1)

- Charleston SC Events (3)

- Charleston SC Information (3)

- Charleston SC Real Estate STATS (1)

- Charleston Second Home (1)

- General (23)

- Summerville SC Area Properties (1)

Recent Posts RSS

Recent Posts RSS

Comments (0)

Please contact us if you have any questions or comments.